What's an Order Book?

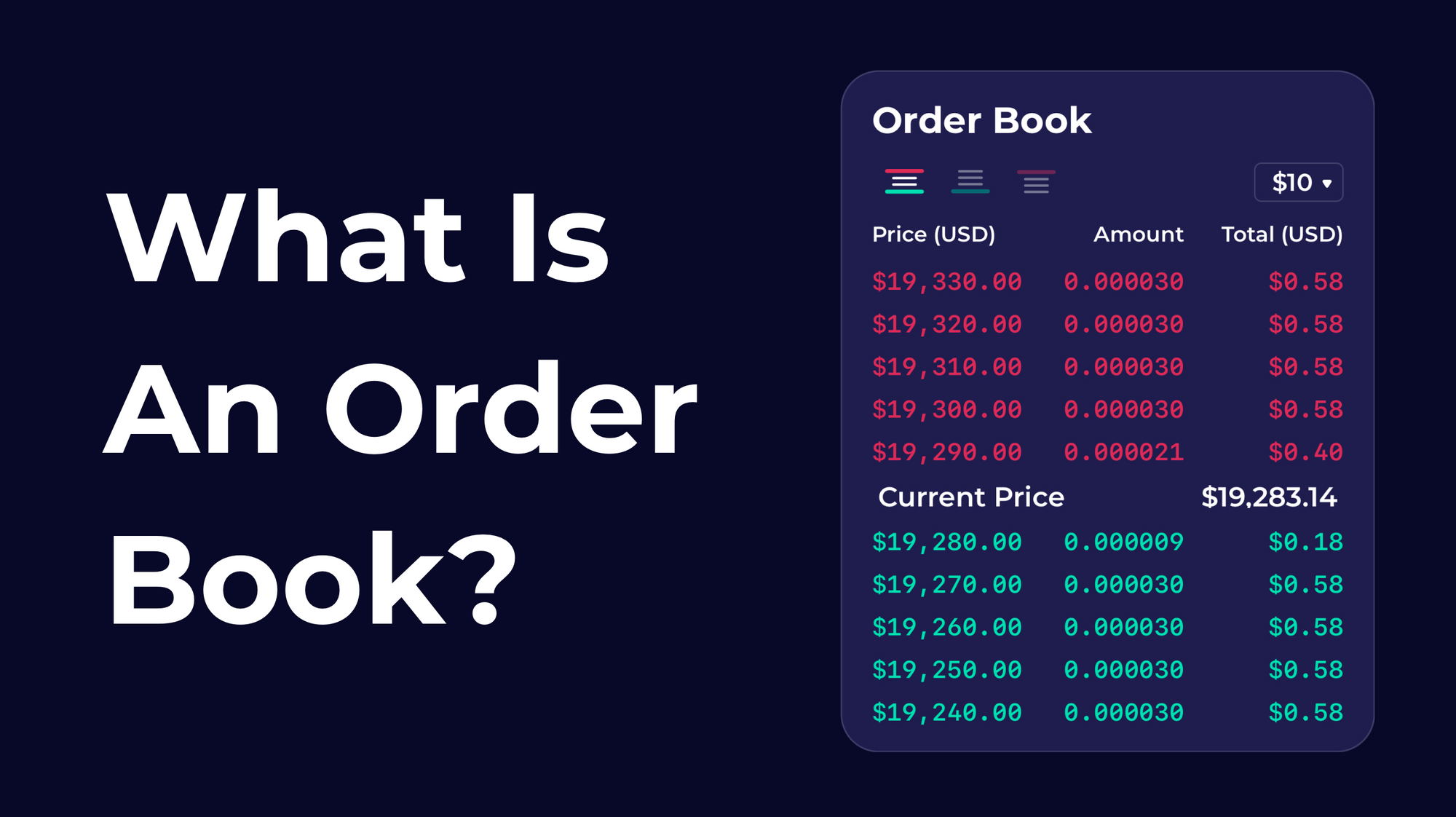

If unfamiliar, an order book might just look like a complicated set of red and green numbers. Intuitively, we all understand that green means go (BUY), and red means stop (SELL). But what is actually going on in the order book?

Well, let’s get into it.

How does an Order Book work?

An order book is used to record the interest of buyers and sellers in a particular asset. So, our order book is used to gauge the level of interest from both buyers and sellers on a particular asset.

An order book is a list of what is going on with both the buy side and the sell side, organized by price.

The orders in green show buy orders at different price levels. Meanwhile, the orders in red show the sell orders at different price levels.

Order Types:

Buy (Instant): Your order is executed at the best price available relative to the current sells in the order book.

Sell (Instant): Your order is executed at the best price available relative to the current buys in the order book.

Be aware, when you enter an amount to buy/sell, an “Average Price” will be calculated for you. This is the “Average Price” that your order will process at. Keep in mind, the “Average Price” can be different than the initial price you viewed the asset at.

Conditional Buy: You’re choosing the maximum price that you’re willing to pay for an asset. As the market reaches the price you set, your order will begin to be filled.

Conditional Sell: You’re choosing the minimum price that you’re willing to sell your ownership of an asset for. As the market reaches the price you set, your order will begin to be filled.

Why is it important?

The order book has a lot of value to you as a collector. It allows you to constantly analyze the existing buy/sell orders. Overall, an order book allows you to see how much the amount you wish to buy or sell may move the market in either direction.

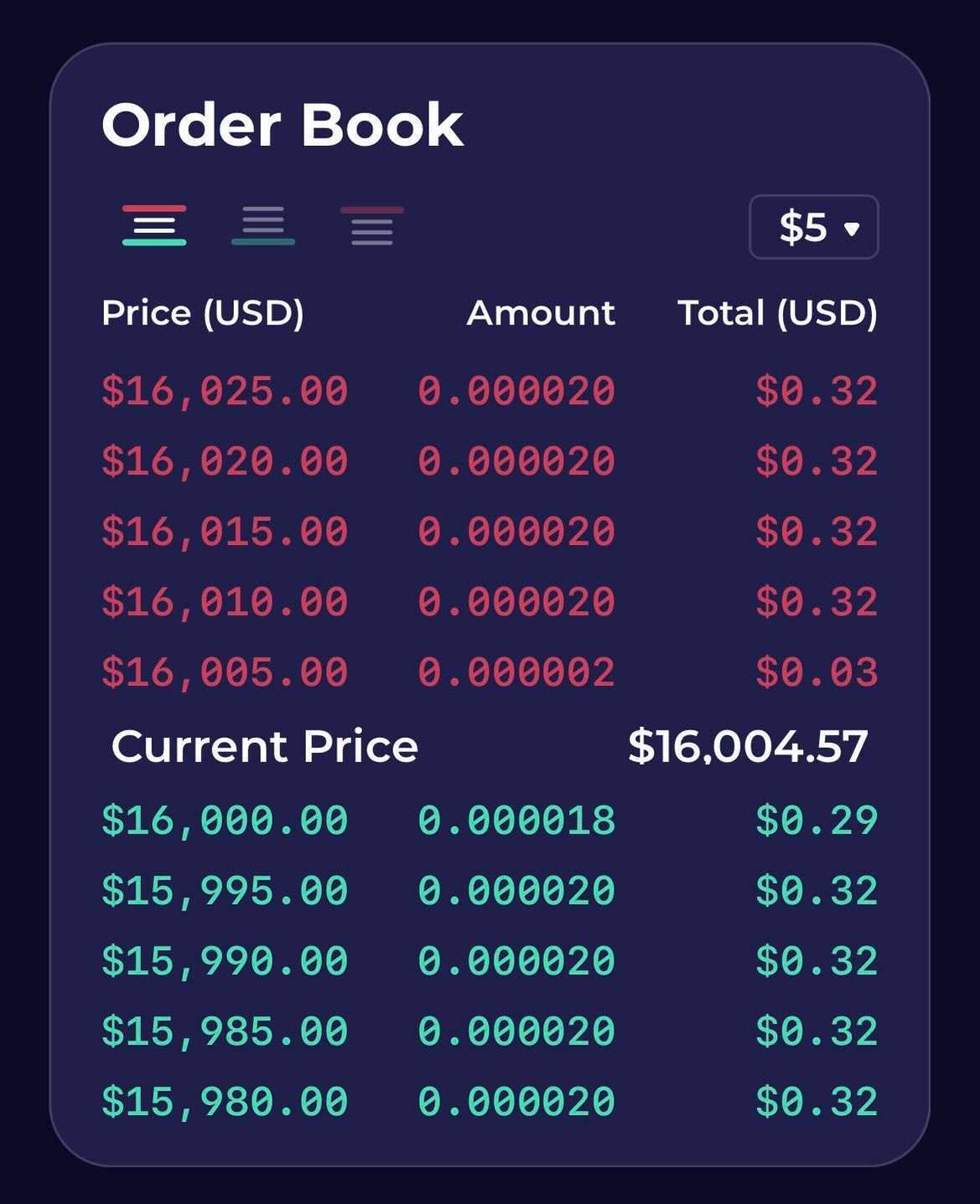

Another important aspect of the order book is the Price Increment Selector in the top right corner. If you set this to $5, then the price is listed in the order book in $5 increments.

If you were to set it to $10, the prices would be listed in increments of $10, and so on. This enables you to see how much is ready to be bought or sold at each price point.

Understanding how the order book works can help you track the market and assess buyer and seller interest at certain price points.

Wrapping it all up:

The most important aspect of this is how it can help you execute trades. Knowledge is a powerful thing. Following and understanding the order book will give you valuable information that can be used to know when to buy or sell a particular asset.