Q&A with Alex de Campi, Writer of Comic Book on Crypto Regulation

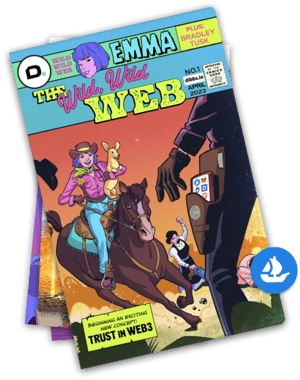

Alex de Campi wrote Dibbs’ debut comic book, The Wild Wild Web, and gives us a deep dive behind-the-scenes.

We had the opportunity to interview Alex de Campi, the writer of Dibbs’ debut comic book The Wild Wild Web, to learn more about her background and the creative process behind the project. Alex shares valuable insights about her previous career as a banking analyst, blockchain qualitative researcher and how it influenced her approach to writing the script.

Dibbs: Alex, could you please introduce yourself in your own words to the readers?

Alex: I'm a comic book writer. I also write films, TV, and novels. I make stuff basically mostly comic books. I've got three coming out this year: Parasocial, Bad Karma and Scrapper. Parasocial is a horror story. It's like misery for the social media age.Bad Karma's like a diehard-style, lethal weapon-style, buddy comedy action story. Those two come out from Image in the fourth quarter of this year. And then I've got Scrapper also from Image that I co-wrote with Cliff Luzinski, who's this video game legend who created Gears of War, Fortnite and games like that. And that's starting to come out in July. So, right now I just live in a haze of deadlines because all of the books are due like, now.

Subscribe to get our best content in your inbox

By clicking “Submit” you agree to Dibbs

Privacy Policy and

consent to Dibbs using your contact data for newsletter purposes.

Dibbs: Can you describe how you got into this space originally? I was reading your author bio and you're like a human Swiss army knife.

Alex: I started off in banking on the money side as an analyst and traveled all around the world for that. Ended up in my company’s London office. Hated it. Also got divorced, and then literally fell in with the wrong crowd at a bar. And that's how it happened.

I always loved comic books, but at a certain point, I put them aside, because I discovered boys, rock and roll, and sports. And then one of the guys in my ex-husband's regiment was PCSing (permanent change of station) and he was like, "Hey Alex, you look like someone who would like comics. I have all these comics at the barracks. Would you like them?" I got this huge stack of like 2000 ADs, which is this great British weekly sci-fi anthology book. And all the really good Vertigo comics from back in the day, like Constantine and stuff like that. I had this huge stack of comics and I kind of got hooked again. Then I started hanging out with artists and making comics and also was still hanging out with music people and started directing music videos. 'Cause I was the organized one in the friends group. And it took off from there.

Dibbs: You wrote "The Wild, Wild Web," Dibbs' first comic book. How did this comic book come about and what piqued your interest specifically about this topic? It's so different from your other works.

Alex: I had done a comic before for Ben [Plomion], who's Dibbs' Chief Marketing Officer. One of the head revenue guys was a very close friend of mine. When Ben and Bryan [Bartlett] had started talking about doing something comic-y, Ben emailed me.

I think a lot of blockchain is a solution in search of a problem right now. But I could see the benefit of what Dibbs was doing specifically in my world, and very easily for both fans and brands and people who have physical collectibles simply from being involved in comics.

You see all these like [Jack] Kirby comic book pages going for almost like getting up to millions of dollars now. Kirby's estate gets $0. It's a regular thing that you see in older comic book artists, ‘cause it's all freelance work – even the Marvel and DC stuff. Running GoFundMe's for their diabetes treatment, or people having to post pictures of them drawing or coloring a comic while they're in hospital because the deadlines won't let up and they need the money.

I love the idea of people potentially being able to sell their physical comic book pages via somewhere like Dibbs, or auction them off via Heritage with Dibbs. Every time the comic book page is resold, the creators continue to get a cut for it.

The traditional secondary market is wonderful, but it does almost nothing for the people who made the stuff. I’ve bought stuff on eBay and it's either not quite what it says it is, it's in worse condition, it gets beat up in shipping, or parts of it are missing. And that's the best you can do. It would be great to know that, if you're buying something that's a collectible, what the real condition of it is, whether it's complete, whether it's safe, et cetera. From the buyer's side, there are a ton of advantages.

Dibbs: Before you talked to Ben and Bryan, what did you know about web3 or blockchain or NFTs before?

Alex: A fair amount. My day job for a while was doing qualitative research at a due diligence consultancy. I would like product due diligence on a lot of tech companies for some of the big VCs. They didn't actually talk to me, they talked to my boss and I was editing interviews with CTOs and tech people about their use of cutting-edge tech. A lot of those were blockchain companies.

I also have a great fascination with financial fraud. This comes back to the consumer safety element and the regulation with Dibbs, which I thought was another really smart move. The way some people are really into true crime, I'm really into financial crime. I love a good scam, and I was just watching the Beanstalk stuff, that actually wasn't really a scam. That was just like speed running the concept of the LBO and the blockchain, which didn't know what it was and therefore just was completely open to being manipulated.

I'm interested in all new cutting-edge tech. I like new stuff. I didn't really see the point of PFPs. I understood why people were buying them because it was like, "Hey, I'm part of this cutting-edge tech club." But it was kind of like a multi-level marketing scam for white nerds. You're buying a jpeg, my dude. Then when people would right-click, download the jpeg and upload it as their profile pic, the nerd would get mad. It never stopped being funny. People were buying this as a membership thing, and also because everyone was really bored a year and a half into the pandemic and had nothing else to do or buy. Ethereum and Bitcoin were doing nothing but going up.

Dibbs: Given your banking background, how do you feel about regulation?

Alex: I knew that regulation was gonna have to come in at some point. Then after FTX, it was really clear that regulation was going to come in and there was no choice. Sam Bankman-Fried ruined it for everybody.

I really like the idea of proactively embracing regulation. I come from a banking background, so I'm very aware of regulated securities compliance. The only thing it harms is crime.

Bradley and the Dibbs comic equate crypto regulation to restaurant inspections. I go to the ramen place around the corner in New York. I buy ramen and eat ramen. I don't get poisoned from ramen, because health inspectors go in on a regular basis and say, “This ramen place is really clean. ‘A’ grade.” I think that's what needs to happen with the blockchain is there needs to be significantly more regulation on exchanges and people providing what are essentially investment products. That will make them follow more rules, but it won't affect the consumers at all. It's just gonna make it less likely that their stuff will be stolen or, you know, their stablecoin will go to zero or et cetera, et cetera. It just means that companies have been just literally flying by the seat of their pants with no real safe backend. Organizations are gonna have to act like grownup companies, and that's mostly why they're whining.

Dibbs: The biggest piece of devil's advocacy that I've gotten when I talk about Dibbs pursuing regulation in crypto is, "Well, scams happen even in regulated industries, Nila.”

Alex: Especially in 2021, people were putting absurd amounts of money in crypto, relative to the risk profile. I saw people who lost their entire savings, or their entire mortgage was on it. Don't do that! I'd watch these people say, "Yay, crypto! Cross-national freedom, no borders, no countries, no governments!" And then they'd lose all their money and be like, "FDIC, please come see!" They wanted their money insured. You say you want one thing, and then when a bad thing happens, you immediately want the other. That was the fastest come to Jesus I've ever seen.

When I was very young and just getting into the entertainment business, my lawyer took me aside and said, "Alex, contracts aren't there for when things are good. Contracts are there to handle [REDACTED] when it gets really bad." I think that's what people need to understand about regulation is it's not there to hinder you when things are good. It's a safety net for you when things are bad. It keeps you from being able to invest in bad actors. If something does happen, it provides some sort of insurance for your life savings that just went up when your memecoin crashed. It's also inevitable.

In order for larger institutions to have more trust in the blockchain and in order for it to go beyond a very tech savvy, cutting-edge group and provide real products and services to a larger amount of people, first, it had to go to proof-of-stake rather than proof-of-work, and that's mostly happened. Hooray! And secondly, it needs to be safe.