How are Web2 Brands Adding Utility to NFTs?

Learn about the different use cases for NFTs, from owning real estate to digital passes, and discover how web2 and web3 brands are approaching NFT utility.

NFTs are rapidly evolving beyond their initial perception as mere digital collectibles or "expensive JPEGs." Major Web2 brands, including Gucci, Nike, and Adidas, are at the forefront of this transformation, leveraging NFTs to revolutionize customer engagement and establish new revenue channels.

So, in this blog, we’ll look at the various utilities NFTs have to offer and how web2 brands are harnessing the unique benefits of NFTs to enhance utility and customer experience.

Subscribe to get our best content in your inbox

By clicking “Submit” you agree to Dibbs

Privacy Policy and

consent to Dibbs using your contact data for newsletter purposes.

How Are Brands Adding Utility to NFTs?

Here are some examples of how web2 brands are utilizing NFTs to enhance customer experiences, create new sales channels, and unlock novel revenue streams.

1. Gucci: Redeemable NFTs

Gucci collaborated with the narrative NFT project 10KTF to launch the Gucci Grail NFTs, allowing owners of popular PFP NFT communities to dress their avatars in digital Gucci pieces.

This initiative was followed by the introduction of the Gucci Vault Material NFT, a mysterious airdrop to Gucci Grail NFT holders, which later revealed a unique opportunity for these holders.

Owners of the Gucci Vault Material NFTs were given the exclusive chance to redeem digital tokens for physical Gucci items – either a wallet or a bag – at no additional cost. These items, not available for purchase by the general public, featured unique design details and the classic Gucci interlocking G pattern and red-and-green stripes.

What can brands learn?

- Leverage exclusivity and scarcity: The concept of 'burning' an NFT to claim a physical item is a masterstroke in maintaining exclusivity. It ensures that the digital and physical items remain rare and desirable, enhancing their perceived value.

- Reward participation: By offering exclusive physical items to NFT holders, Gucci not only rewarded early adopters but also encouraged long-term engagement with the brand.

2. Tomorrowland: Event Tickets and Passes

The Tomorrowland NFT project, the Medallion of Memoria, serves as a prime example of how NFTs can be used to enhance customer experiences, build community, and create innovative marketing strategies in the entertainment industry.

The Medallion of Memoria is unlocked by collecting all three NFTs from the Tomorrowland series: "The Reflection of Love," "A Letter from the Universe," and "The Symbol of Love and Unity."

Owners of all three NFTs can access a special portal, where they find information about sales, turn in their NFTs, and join future initiatives. This portal offers exclusive access to Tomorrowland 2023 tickets, presale information, and details on secret shows.

What can brands learn?

- Find ways to encourage long-term engagement: The staggered release of NFTs and the ongoing nature of the benefits encourage long-term engagement within the community. This keeps the community active and engaged over time, rather than focusing on a one-time interaction.

- Leverage shared interests and passion: Tomorrowland's NFTs are centered around a shared passion for music and the festival experience. This shared interest is a powerful tool for community building as it creates a sense of belonging and connection among individuals.

3. TripleS: Governance and Voting Rights

K-pop group TripleS utilize an NFT-based governance system that allows fans to directly influence the group's music and formation.

This unique approach was recently showcased in the release of their new album “ASSEMBLE” where fans selected the title track through a voting event named "Gravity" on the official "Cosmo: the Origin" app.

To cast votes and influence the band’s key decisions, fans must purchase “objects” which are either NFTs of the band’s exclusive photographs or offline merchandise. Each “object” can then be converted into COMO, which can be used to cast votes.

What can brands learn?

- Build a participatory culture: By allowing fans to influence significant aspects of the group's activities, tripleS fosters a participatory culture. Brands can adopt this approach to make their customers feel more connected and integral to the brand's journey.

- Create habitual engagement: The Cosmo app offers fresh, exclusive content everyday, such as behind-the-scenes photos, which they can purchase everyday. This creates a compelling reason for fans to return frequently and not only keeps the audience engaged but also strengthens their emotional connection with the band.

4. Lufthansa: NFT-based Loyalty Program

Lufthansa Group has launched an innovative NFT-based loyalty program called "Uptrip," which is set to redefine the airline passenger experience. This program, encompassing all airlines under the Lufthansa Group including Austrian Airlines and Swiss International Air Lines, allows passengers to collect digital trading cards themed around destinations, aircraft, and holidays.

The unique aspect of the Uptrip program is that by collecting sets of these NFT-based trading cards, passengers can unlock special perks. These perks include free in-flight Wi-Fi, access to airport lounges, redeemable airline miles, and more.

Additionally, Uptrip is planning to introduce a trading feature, enabling users to complete their collections by trading cards with others. This program, which was soft-launched and tested with over 20,000 users, has already seen the collection of more than 200,000 digital trading cards.

What can brands learn?

- Gamify the loyalty experience: Lufthansa's Uptrip program demonstrates how gamification can be effectively used to enhance customer loyalty. By turning the collection of NFTs into a game where passengers can earn rewards, Lufthansa creates an engaging and interactive experience.

This approach not only makes the loyalty program more appealing but also encourages repeated interactions with the brand. - Personalize marketing strategies: Lufthansa's Uptrip program showcases how NFTs can be employed to further personalize customer experiences. By leveraging the data capabilities of blockchain technology, the program can potentially track and analyze individual customer preferences, such as favored destinations or travel habits.

This information can then be used to tailor the NFT offerings and rewards to each customer's unique interests, making the loyalty experience more relevant and engaging.

Elevating web2 brands with strategic NFT integration, powered by Dibbs

Today, traditional Web2 brands have an opportunity to redefine their relationship with audiences through the strategic integration of NFTs. Beyond being mere collectibles, NFTs can serve as powerful tools for providing utility, deepening engagement, and fostering trust within the community.

However, strategic utility is the key to successful NFT integration. For brands looking to navigate the NFT space seamlessly, Dibbs emerges as a strategic partner. With a focus on utility-driven NFTs, Dibbs enables brands to foster community engagement, enhance brand loyalty, and unlock new revenue streams.

To learn how Dibbs helps create interactive experiences that resonate with your audience, schedule a demo with Dibbs today.

Explore the limitless possibilities of NFTs with Dibbs – your partner in creating an interactive experience that resonates with your audience.

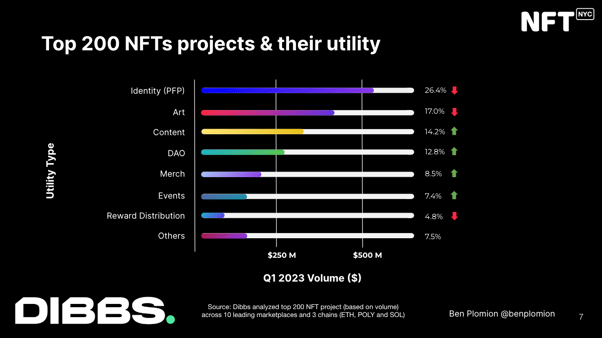

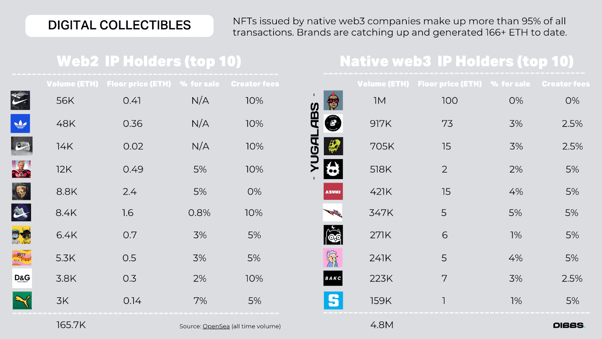

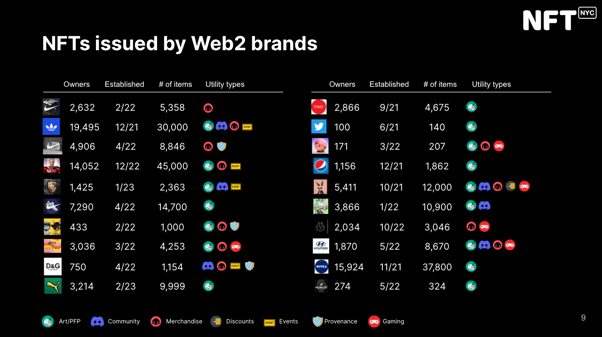

View our full presentation from NFT.NYC 2023 below:

Ben Plomion

Ben Plomion is Dibbs' Chief Marketing Officer. As a child, Ben collected comic books and Panini Football stickers. Now, Ben's PC consists of physical-backed NFTs.